At this point last year, the market was in a roughly similar spot, but the mood could hardly be more different.

S&P 500 was up 7.4 percent year-to-date this time last January, in one of the best starts to any year, and investors were giddy, greedy and comfortable, on the whole, with the reasons for the gains.

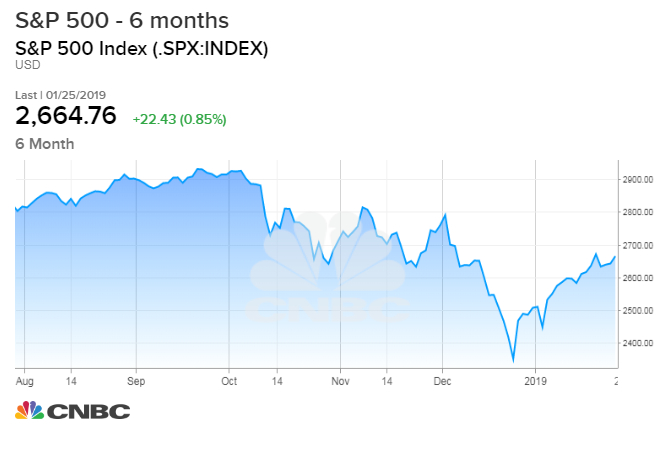

Today the index is ahead by 6.3 percent less than four weeks into the year, and investors are relieved but also ambivalent and gun-shy — unsure if the bear raid of the prior few months is over or only in abeyance.

The fragile psychology and tentative stance of market participants right now will probably serve the market well for a while, according to strategists who track supply-and-demand dynamics and the market’s own response to fundamentals.

Fundstrat Global Advisors strategist Thomas Lee says, “Investor conviction is low, whether a bull or a bear — not surprising given the savage volatility seen in December 2018, which effectively destroyed the playbooks for most investors.”

Tobias Levkovich of Citigroup notes that this attitude prevails globally: “A trip visiting clients in Singapore, Hong Kong, Taipei, Tokyo, and Sydney left us with the sense of underlying discomfort with the market’s strength since last December.”

The S&P 500 was almost exactly flat last over the four trading days last week after dropping more than 1 percent Tuesday – a creditable showing given its 13-percent sprint from Dec. 26 through last Friday’s high. The index remains nearly 10 percent off its September high, preventing many long-term investors from running any victory laps.

A pullback appeared logical from the Jan. 18 closing high of 2670, and one still does. But the neutral, diffident sentiment and still-reserved level of risk-taking among professional and institutional investors is a net positive and would limit the depth of a setback, all else being equal.

The final week of January in 2018, of course, marked the sentiment, momentum and valuation peak of this bull market so far — reflecting the most overbought, overloved, overvalued condition seen since the year 2000. At that time, the just-passed tax-cut was juicing corporate-profit forecasts and stoking animal spirits — and the main risk to the market seemed an overheating U.S. economy firing up inflation and inflaming Federal Reserve tightening intentions.

from Update News Zone http://bit.ly/2DEPN7q

0 Comments